Corporate Governance

Our Approach to Corporate Governance

SmartHR respects the positions of all stakeholders of the SmartHR Group, including its shareholders, customers, employees, and local communities. By making transparent, fair, prompt, and resolute decisions, we aim to respond to changes in the business environment and enhance our long-term corporate value.

Specifically, we will build internal systems that enable rational decision-making processes and efficient business execution. We will also strengthen our corporate governance via the effective oversight of outside directors, Risk Management Committee, the establishment and operation of internal control systems, and the reinforcement of compliance frameworks.

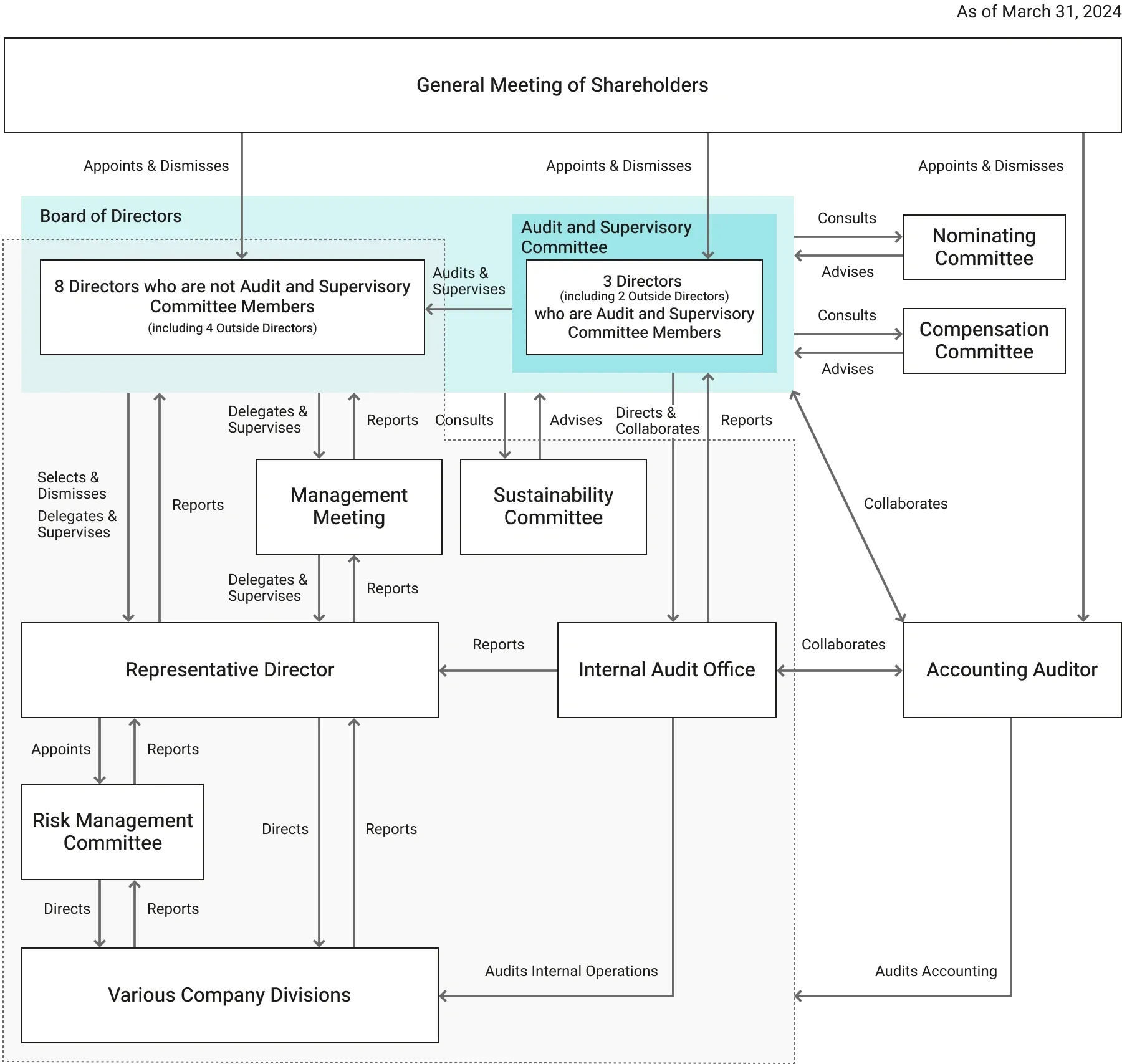

Corporate Governance Structure

We have adopted the organizational structure of a Company with an Audit and Supervisory Committee. Our corporate governance framework is structured as follows:

Board of Directors

Overview of the Board of Directors

The Board of Directors is responsible for making decisions on the company's management policies, strategies, business plans, major asset transactions, high-priority organizational and personnel matters, and supervising the execution of duties by the representative director.

To ensure objectivity and diversity of views in terms of supervision and decision-making, 6 out of our 11 directors are outside directors. When nominating candidates for the Board, we consider their achievements, experience, knowledge, and character, both within our company and elsewhere. The Board selects suitable candidates and proposes them at the General Meeting of Shareholders.

The Board meets monthly, with additional meetings held as needed. As per our Articles of Incorporation, the number of directors who are not Audit and Supervisory Committee members is capped at 10. Their election requires approval at the General Meeting of Shareholders, attended by shareholders with at least one-third of voting rights, and passed by a majority vote. Cumulative voting is not used.

For more information about our non-Audit and Supervisory Committee members, see the "Executive Team" section.

Established Regulations

We have established Board of Directors Regulations to clarify operational matters, aiming to ensure the legality and transparency of the Board's proceedings.

Promoting Gender Diversity

We recognize that increasing diversity on the Board enhances the quality of management decision-making. In line with this, we are actively promoting the appointment of female directors. As of December 31, 2024, women represent 18% of our Board, and we remain committed to further increasing diversity.

Deliberations on Conflicts of Interest

We understand the risks associated with directors potentially benefiting themselves or third parties in transactions that conflict with the company's interests. To manage this, any such transactions are resolved by the Board in accordance with the Companies Act. During these deliberations, external directors provide objective oversight, ensuring transparent operations in cases involving conflicts of interest.

Deliberations on Transactions with Related Parties

To ensure sound corporate governance, our company requires directors to report in advance to the Board of Directors before engaging in any competitive transactions or transactions that may involve conflicts of interest. This requirement is strictly enforced from the time of their appointment. The Board of Directors deliberates on and makes resolutions regarding such transactions. Additionally, for other related party transactions, we conduct a prior legal review in accordance with the Related Party Transaction Management Regulations to assess business necessity and ensure the appropriateness of transaction terms. These transactions are also reported to the Board of Directors on a regular basis.

Audit and Supervisory Committee

Overview of the Audit and Supervisory Committee

The Audit and Supervisory Committee conducts comprehensive audits across all business activities, evaluating the appropriateness of policies, plans, and procedures, the effectiveness of business execution, and compliance with laws and regulations. This includes reviewing important approval documents and investigating subsidiaries. The committee receives regular reports on audit plans, methods, and outcomes from both accounting auditors and the internal audit department and provides feedback to directors.

The committee consists of three members: one full-time director and two part-time external directors. Meetings are held monthly, with additional sessions as needed. According to our Articles of Incorporation, the committee can have up to five directors. Their election requires a resolution passed at the General Meeting of Shareholders, attended by shareholders with at least one-third of voting rights, and must be approved by a majority vote.

For more information about our Audit and Supervisory Committee members, see the "Executive Team" section.

Established Regulations

We have established the Audit and Supervisory Committee Regulations to clarify operational matters, aiming to ensure the legality and transparency of its proceedings.

General Meeting of Shareholders

Principle of One Share, One Vote

We adhere to the provision in the Companies Act of Japan that requires shareholders to be treated equally in proportion to the content and number of shares they hold (the principle of one share, one vote). This principle is applied at the General Meeting of Shareholders and in other relevant contexts.

Anti-Corruption Measures

Approach to Anti-Corruption Measures

The Group has established an Anti-Corruption Policy. To ensure its thorough understanding, we have systems in place that allow all employees to access and review this policy.

Whistleblowing System

In line with our Anti-Corruption Policy, we have set up an internal reporting hotline that officers and employees can use to report any violations. This hotline ensures confidentiality and anonymity.

Data Related to Anti-Corruption Measures

Total Amount of Political Contributions

Policy

As stipulated in our Anti-Corruption Policy, our Group prohibits donations to political parties or candidates unless approved by our Legal Unit.

Disclosure for the Most Recent Fiscal Years

The total amount of political contributions for the recent fiscal years is as follows:

| Data Item | FY 2023 | FY 2024 |

|---|---|---|

| Total Political Contributions | 0 yen | 0 yen |

Disciplinary Actions and Dismissals Due to Anti-Corruption Policy Violations

Disclosure for the Most Recent Fiscal Years

The number of employee disciplinary actions and dismissals due to violations of the Anti-Corruption Policy is as follows:

| Data Item | FY 2023 | FY 2024 |

|---|---|---|

| Disciplinary Actions | 0 cases | 0 cases |

| Dismissals | 0 cases | 0 cases |

Costs Related to Fines, Penalties, and Settlements Due to Corruption

Disclosure for the Most Recent Fiscal Years

The costs incurred for fines, penalties, and settlements related to corruption are as follows:

| Data Item | FY 2023 | FY 2024 |

|---|---|---|

| Fines | 0 cases | 0 cases |

| Penalties | 0 cases | 0 cases |

| Settlements | 0 yen | 0 yen |